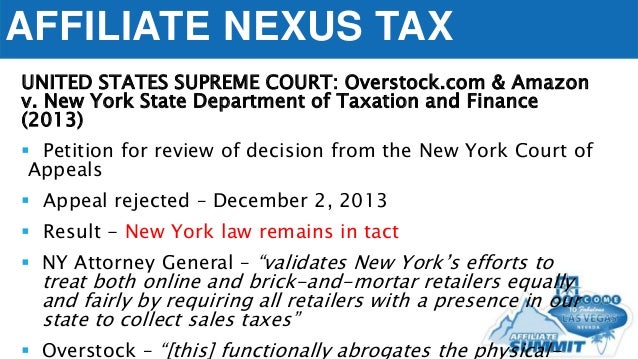

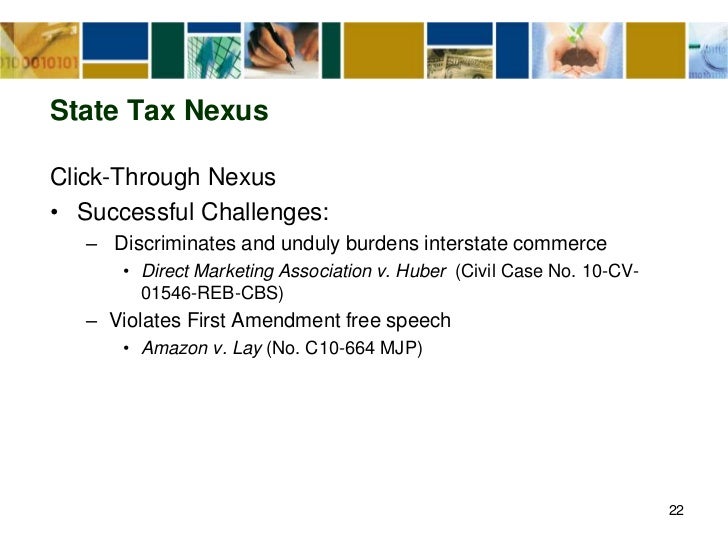

What happens if i have sales tax nexus? if you have sales tax nexus in a state, then you must collect sales tax from buyers in that state. this means you must. This chart lists the states that have passed one or more of the following types of legislation, along with the effective date for that type of legislation: click. A definition and discussion of the term tax nexus and how it affects business income taxes, online businesses, and sales taxes..

A consumption tax imposed by the government on the sale of goods and services. a conventional sales tax is levied at the point of sale, collected by the retailer and. Nontaxable sales some internet sales are not taxable. common exempt transactions. some of your internet sales—including sales for resale, sales of cold food. Amazon tax collection policy has changed over the years. in the u.s., state and local sales taxes are levied by state and local governments, not at the federal level..

0 komentar:

Posting Komentar